Daily Dolr: How Borrowers can Automate Their Good Habits

If you have a $30,000 loan balance, and you’re making standard payments on a 10-year term (we’re assuming a 4% interest rate), paying $100 extra a month gets you out of debt THREE YEARS EARLIER.

I’m sure you’ve heard that aphorism: The road to hell is paved with good intentions.

I don’t know about hell, but good intentions are definitely paving the way to a road that leads directly away from your goals.

You plan to put some extra cash each month toward your student loans. The first month you remember. Maybe even the second month, but then life takes over. Your car needs a repair. You get wrapped up in a new relationship. Before you know it, you’ve completely forgotten about that whole extra payments idea.

Don’t feel bad — it’s not a you problem. It’s a human beings problem. We’re bad at creating new habits.

That doesn’t mean we can’t create them. It just means we need help.

As James Clear wrote in Atomic Habits: “The best way to create a good habit is to automate it so you never have to think about it again.”

Why is paying extra toward your loans a good habit?

Let’s tackle the big question first. Why would you even want to do this?

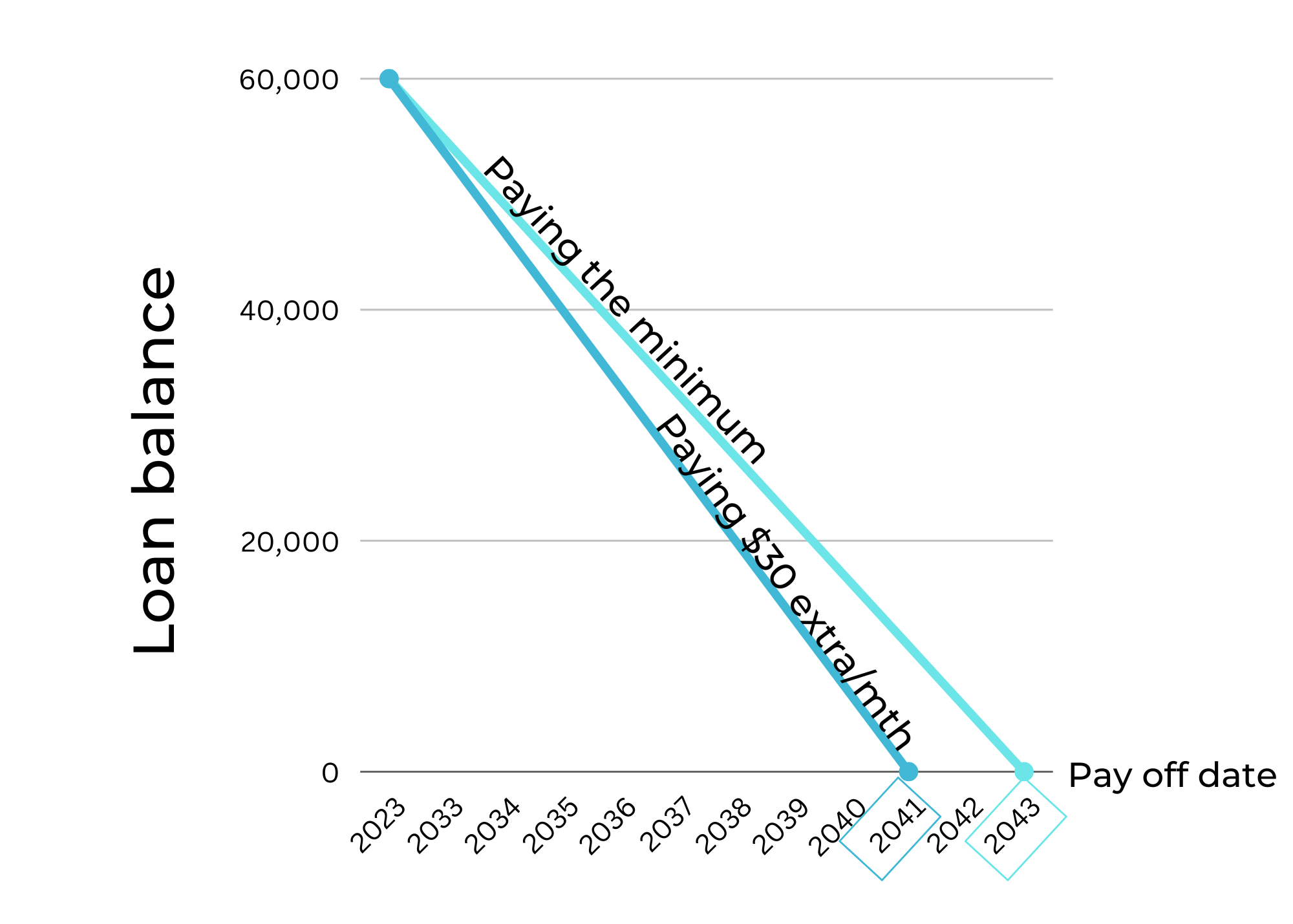

I’m going to answer with a graph.

If you have a $30,000 loan balance, and you’re making standard payments on a 10-year term (we’re assuming a 4% interest rate), paying $100 extra a month gets you out of debt THREE YEARS EARLIER.

That’s 36 more months of your life knowing that you’ll never have a student loan payment again. A Dolr member told me recently that her life could really start once her student loans were paid off. This is one of the best ways to reach that goal sooner.

Plus, in the scenario I’ve laid out, the person paying the monthly minimum ends up paying a total of $36,467 in student debt repayment.

The person who pays $100 extra a month? They only pay $34,524.

Those extra payments save them almost $2,000.

Okay, but let’s say you owe double that amount, and you’re on a 20-year payment plan. And you don’t have $100 extra a month to put toward your loans. There’s no point in you making small extra payments because you can’t really make substantial progress, right?

Wrong.

Let’s take that scenario: $60,000 in debt with a 20-year term. What’s the difference if you pay the minimum or if you pay an additional $30 a month?

Check out that graph. You’d be paying off your debt two years earlier. And you’d save $3,365 in interest payments. What could you do with over $3,000?

Now let’s really go wild.

What if your employer is paying $100 toward your student loans? You may be inclined to celebrate your good fortune and go about your way. But what would happen if you capitalized on it and added your own extra payments to what your employer’s contributing.

So in the first example, instead of an extra $100, that borrower and their employer together are contributing an extra $200. They can pay off their debt in full by 2028 — in just 5 years. And they save almost $3,000 in interest.

What about the person with $60,000 in debt and a longer payment term. If they add their employer’s $100 per month and their own $30 per month, they pay off their debt by 2036. That’s SEVEN years early. And they save over $10,000 in interest.

Use our student loan calculator to see how much you could save.

How can Daily Dolr help automate your good habits?

Daily Dolr allows you to direct a specific amount of money every month toward your student loan payment (in addition to whatever your monthly payment is).

You can use Daily Dolr to:

- Set up either daily or weekly extra payments to your student loan account

- Split your monthly payment into weekly payments (more on this below)

However you choose to use Daily Dolr, once a week we make a payment on your behalf to your student loans.

After you set it up, your habit is fully automated. No more relying on your memory or your own willpower to keep it going. We got you.

Try this automation hack to pay your debt off even faster

Want to pay your debt off even faster? You can pay your student entirely through Daily Dolr, one week at a time instead of monthly.

What’s the benefit of that?

Because each month doesn’t have exactly four weeks in it, automating a weekly payment means you actually pay a bit extra without thinking about it.

Here’s an example:

Let’s say you’re paying $400 a month toward your student loans. You’ll pay $4800 in total over the course of the year. But instead, imagine that you’re paying $100 a week. You’ll actually pay $5200 over the course of the year (about $33 extra a month), and you’ll be out of debt sooner (and pay less interest).

What about the 0.25% interest rate break you get from your loan servicer for setting up automatic payments with them?

Here’s the uncomfortable truth: That 0.25% break serves your lender way better than it serves you.

Why? when you set an automated payment with your servicer directly, they get to streamline their accounting AND make more interest off you because most people don't automate more than the minimum amount.

What do you get out of the deal? Basically nothing -- that 0.25% interest break saves about $500 OVER TEN YEARS.* That's just crazy talk.

Compare that to making weekly payments with Daily Dolr: you save almost $1000 in interest and are out of debt a year sooner.

What if I don’t have enough in my bank account for Daily Dolr?

Not everyone has a set-it-and-forget-it kind of income stream. If you’re worried about signing up for Daily Dolr because you might not always have enough in your bank account to cover the cost of the withdrawal, never fear.

Daily Dolr ensures you have enough cash available in your account before making any withdrawals. In fact, just to be safe, we make sure you have at least 3 times the amount. For example, if you do $5/day we check to ensure you have at least $15 in the account before we initiate a transfer.

We know (and you probably do too) that eliminating debt is a critical first step to building wealth. Taking that step is waaaay easier when you can automate your good habits — and when you know there’s a whole community of Dolr members cheering you on. So go ahead and sign up for Daily Dolr today.

*We’re basing this on $30k loans at a 4.25% or 4% (with the 0.25% rate break) interest rate over 10 years.