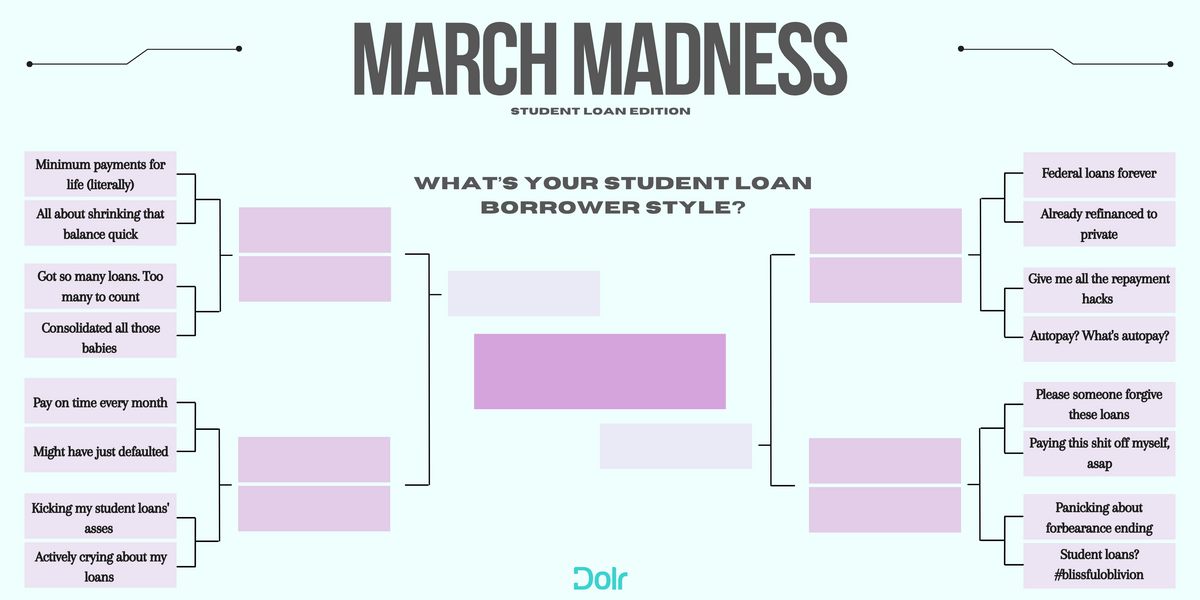

What’s Your Student Loan Borrower Style?

March Madness is upon us. It also happens to be less than two months before student loan repayments start up again for federal borrowers.

March Madness is upon us. It also happens to be less than two months before student loan repayments start up again for federal borrowers.

So why not have a little fun while there’s still fun to be had? We whipped up this student loans bracket in the spirit of the season. And because we know there’s nothing a student loan borrower loves more than free cash, we’re throwing a little money in the pot. Everyone who posts a photo of their completed bracket on social media before April 4 and tags us @getdolr will be in the running for $250 student loan payment (each social network follow and share count as a separate entries: instagram, twitter, facebook, linkedin).

Minimum payment for life (literally)

Yes, it sucks to have a student loan balance. But for you, it would suck more to think about getting rid of it. You’ve got that autopay set to the minimum balance, and you just don’t think about it after that.

So you’ll be making that monthly payment until you’re retired? There are worse things you could be paying for than your education.

All about shrinking that balance quick

You are ready to shed this debt. You use the Daily Dolr to pay extra every month, you make extra payments when you get a tax return or some extra cash on your birthday.

It means you have a little less fun money today, but you’re willing to make that sacrifice for a better financial future.

Got so many loans. Too many to count

Your monthly student loan bills need a folder all for themselves. You have federal ones, private ones, undergrad loans, graduate school loans. You can barely tell which is which, but consolidating feels like such a hassle.

You’ve got them all on autopay, and it’s only really terrible when you have to do something like change your address or your bank account draw…17 times.

Consolidated all those babies

You consolidated your loans the first chance you got, and you can’t help feeling a little superior every time you make that single monthly payment. No, you’re not saving any money by doing it, but your sanity is way more important anyway. And having more than one student loan bill would make you crazy.

See: Borrowers Like You: From a Ballooning Loan Balance to a Pay-off Plan

Pay on time every month

The idea of paying a bill late gives you hives. You have every single bill on autopay, and you still check every month to make sure that payment is scheduled to come out on time. And…then you check afterwards to make sure it did.

Maybe a little over the top, but hey — you’ve never had to pay a late fee.

Might have just defaulted

Things are not looking good in student loan land. You struggle to make payments on time every month. You didn’t set up autopay because you were worried you’d overdraw your bank account if you weren’t paying attention to the balance.

But now you regularly miss payments and struggle to manage your cash flow. Might be time to talk with a credit counselor.

Kicking my student loans’ asses

It’s not just that you’re paying more than the minimum every month. It’s the regularly updated spreadsheet on your computer and the repayment progress thermometer poster you DIYed for your refrigerator (#thatcraftylife).

You know exactly what date and day of the week you’ll make that last payment, and you’ve already started planning your celebratory event.

Actively crying right now

Student loans can cause a lot of stress and sadness, and they’ve got you down. Your loan balance is so high that it’s hard to see how you’ll ever make progress. How will you ever have enough money to buy a house? Or have a baby? Save for retirement?

The numbers have you so overwhelmed that you can’t make a plan beyond not defaulting.

Federal loans forever

If the pandemic has taught you anything about finances, it’s that there’s a great reason to keep your student loans with the federal government. Living through a pandemic is not something you’d like to try again, but not having to make your student loan payments made it slightly less awful.

Who knows what could happen in the future? You’re not giving up the possibility of deferment or forbearance if you need it again one day.

Already refinanced to private

You saw those low, low interest rates a couple years ago and dove right in. You missed out on the pandemic forbearance your peers were getting, which was a little tough to take.

But with that super low interest rate and you keeping up payments for the last two years, you’ve shrunk your balance in a way many of your fellow borrowers haven’t. So you’re focusing on that long-term gain.

Give me all the repayment hacks

If there’s a way you can lawfully get someone else to share the cost of your student loans, you’re going after it. You started paying the interest on your student loans while you were still in grad school because you were not going to let the federal government make that money off you. You campaigned to get your employer to start a loan repayment assistance program — and succeeded.

Now you’ve signed up for Shop & Pay because why should you shop without getting some kind of benefit?

See: 9 Student Loan Hacks to Help You Pay Your Debt Faster

Autopay? What’s autopay?

Oh dear. You really stuck your head in the sand on this one. You so badly wanted to ignore your student loans’ very existence that you’ve missed out on the opportunity to reduce your interest rate by .25%. May not sound like much, but that quarter percent could save you hundreds or even thousands of dollars over the life of your loan.

Plus, it makes having loans easier for you. They just take the money right out of your account, so you can be sure you’re always paying on time.

Please someone forgive these loans

You have made every career decision since graduating based on the possibility of getting these loans paid off. You’ve filled out and filed every necessary piece of paperwork, and you’ve turned down job opportunities that would’ve taken you out of eligibility.

You also almost pass out every time you hear about someone not getting their awaited forgiveness.

Paying this shit off myself, asap

Nothing wrong with public service, but it just isn’t your thing. And you didn’t want to be sweating whether the federal government would uphold its end of the bargain. So you made a plan to pay it off yourself.

You might even get it paid off before your peers meet their loan forgiveness eligibility requirements — not that it’s a competition or anything.

Panicking about forbearance ending

The date May 1, 2022 is seared into your brain. That’s when you’ll have to wake up from the dream that has been not making student loan payments for the last two years. And you’re worried you may have completely forgotten how to budget or even make ends meet with that big chunk coming out of your bank account again.

You’re halfway hoping it gets extended again, but you have a sinking feeling this time it’s going to stick.

Student loans? #blissfuloblivion

When you got the email that your student loans would be in forbearance because of the pandemic, you promptly shut the door to the student loans room in your brain and threw away the key.

You haven’t thought about your student loans since, and you probably won’t until someone shows up in your inbox or your mailbox asking for money. You’ll deal with it then.

No matter what kind of borrower you are, we have tools that can help you get out of debt faster. Start by checking out the Daily Dolr.

Contributed by Katie Taylor.