Everything You Need to Know About Biden’s Student Loan Forgiveness in 2022

Since Biden’s announcement, borrowers have been scrambling to understand how the debt relief will work, whether they’re eligible, and what they need to do. Here’s everything — and we mean everything — you need to know.

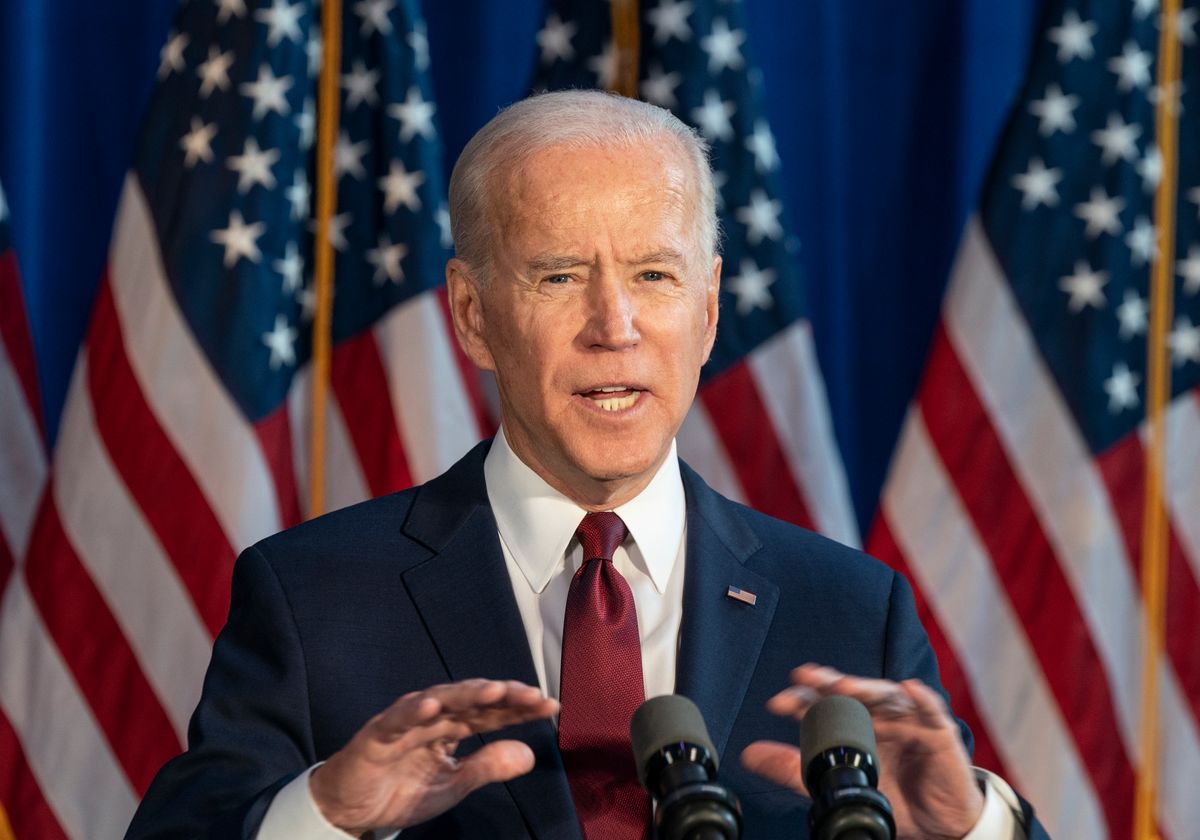

On August 24, 2022, President Biden made the long-awaited announcement that his administration would be forgiving a portion of student loan debt for some borrowers.

With many people calling for complete student loan debt relief throughout Biden’s campaign and during his presidency, it was a less robust plan than many people wanted. Even so, millions of borrowers will benefit from the forgiveness. In fact, the White House estimates that up to 20 million eligible borrowers will have their entire debt balance canceled.

Since Biden’s announcement, borrowers have been scrambling to understand how the debt relief will work, whether they’re eligible, and what they need to do.

Here’s everything — and we mean everything — you need to know.

- What does student loan forgiveness mean?

- Who qualifies for student loan forgiveness?

- Which loans are forgiven under Biden’s student loan forgiveness plan?

- What are the student loan forgiveness income limits?

- How much student debt can be forgiven?

- How do I know if I received a Pell Grant?

- Will student loan forgiveness apply to current students?

- Will student loan forgiveness include Parent PLUS loans?

- Will student loan forgiveness include private loans?

- Is student loan forgiveness automatic?

- When will student loan forgiveness go into effect?

- Will student loan forgiveness be taxed?

- When will student loan repayment start?

- What if I don’t qualify for student loan forgiveness?

- What are student loan forgiveness calls?

What does student loan forgiveness mean?

You may have felt like your loans were forgiven for the last two and a half years — 0% interest and no payments was pretty sweet. But all those loans were just in a repayment freeze, and that’s about to end.

Forgiveness is permanent.

Student loan forgiveness occurs when the federal government cancels all or a portion of your student loan debt. There are many types of student loan forgiveness — Public Service Loan Forgiveness, Teacher Loan Forgiveness, and Federal Employee Student Loan Forgiveness, to name a few.

What we’re talking about today is Biden’s student loan forgiveness plan, announced in August of this year. Biden’s plan promises to forgive a certain amount of money for student loan borrowers who meet income eligibility requirements.

Federal student loan debt relief is about investing in the middle-class. For millions of Americans who are unable to buy a home, start a family, or save for retirement because of student loan debt, @POTUS’s plan is life changing. https://t.co/DCA7hdEhFp pic.twitter.com/EVzvzBGCvU

— Secretary Miguel Cardona (@SecCardona) September 2, 2022

Let’s break that down.

Who qualifies for student loan forgiveness?

People who borrowed money from the U.S. Department of Education — including parents, spouses, and students themselves — before June 30, 2022 may qualify for student loan forgiveness.

Whether you’re eligible depends on the type of loans you have and what your income was in 2020 or 2021.

Which loans are forgiven under Biden’s student loan forgiveness plan?

President Biden’s plan is focused on forgiving student loans issued by the U.S. Department of Education.

Loans eligible for forgiveness are:

- Direct subsidized loans

- Direct unsubsidized loans

- Direct consolidated loans

- Perkins loans

- PLUS loans

I’ve seen your questions about which loans qualify for forgiveness.

— Secretary Miguel Cardona (@SecCardona) September 1, 2022

All @usedgov-held loans are eligible! Share this post and spread the word. pic.twitter.com/6NLy52wSLq

These loans are eligible whether you took them out for undergrad or graduate school, whether you were the student or the student’s parent or spouse.

Which loans are left out? Commercially held FFEL (Federal Family Education Loan) loans, which impact about 5 million borrowers.

Brief history lesson: The student lending system began in the 1960s, and at that time, the Federal Government didn’t actually give out any money. Instead, private banks or nonprofits provided the loans, and the Federal Government guaranteed them. All that happened under the FFEL program.

Even though these loans were guaranteed by the Federal Government, President Biden can’t mandate debt relief because they’re privately owned. (And unfortunately for FFEL borrowers, they didn’t get the relief of the pandemic payment pause for the same reason.)

There is some indication that the U.S. Department of Education is trying to work with the private lenders to make FFEL loans eligible for forgiveness. It’s unclear whether that will be successful.

If you have FFEL and you would otherwise qualify for the student loan forgiveness program, you may want to consolidate your loans through the Federal Direct Loans program now. You can do that on the StudentAid.gov website by filling out the federal direct consolidation loan application.

If you don’t know what type of loans you have or whether your FFEL loans are commercially held, you can find that information on the StudentAid.gov website under “My Aid.”

What are the student loan forgiveness income limits?

You can receive forgiveness if your income was less than $125,000 per year during the pandemic. If you are married or the head of a household, your household income must have been less than $250,000.

The number you’ll need to verify your income is the AGI (adjusted gross income) on either your 2020 or your 2021 tax return. If you filed on IRS Form 1040, that’s the number on Line 11.

How much student debt can be forgiven?

If you have federal student loans, you may be eligible to receive forgiveness for up to $10,000 of your student loan debt.

If you received a Pell Grant to pay for any of your educational expenses, you may be eligible to receive forgiveness for up to $20,000 of your student loan debt.

Forgiveness is capped at $10,000 (or $20,000 for those with Pell Grants). Your forgiveness amount could be less if your total loan balance is lower than the cap. For instance, if you have $8,000 in loans, the Federal Government will forgive that $8,000. They will not reimburse you for the additional $2,000 that could have been forgiven had your balance been higher.

How do I know if I received a Pell Grant?

Pell Grants are provided to undergraduate students with exceptional financial need.

To determine whether you received a federal Pell Grant, log onto your account at StudentAid.gov. The “My Aid” section of your dashboard will show information about grants, including whether you received a Pell Grant.

Will student loan forgiveness apply to current students?

Student loans taken out after June 30, 2022 will not be eligible for forgiveness.

If you’re a current student who took out loans before that date, your previous loans may be eligible for relief (assuming they meet the other eligibility criteria).

We should also note here that graduation is not a requirement for Biden’s student loan forgiveness plan. You may be eligible for forgiveness if you did not complete your degree.

Will student loan forgiveness include parent PLUS loans?

Student loan forgiveness covers all U.S. Department of Education loans. That includes Parent PLUS loans.

If you took out the Parent PLUS loans before June 2022 and your individual or household income falls below the income thresholds, then you are eligible for debt relief.

Will student loan forgiveness include private loans?

Sorry, folks. If you took out private loans or refinanced your federal student loans, those loans are not eligible for forgiveness.

The loss of federal benefits (like forgiveness) is one of the key things to consider when you’re thinking about refinancing your student loans. In fact, the Consumer Financial Protection Bureau has raised some concerns about private lenders not providing needed information about the implications of refinancing — especially now.

Is student loan forgiveness automatic?

It depends. The Department of Education will provide a student loan forgiveness application by October for borrowers to provide their income information.

The Department also said that they already have income information for about 8 million borrowers. Those people may get automatic forgiveness without filling out an application.

Our take? Unless you’ve received notification that you’re getting automatic forgiveness from your loan servicer (or you’ve witnessed a miraculously smaller loan balance), fill out that application once it’s available.

You can sign up for email updates and get the application as soon as it’s available by going to the Department of Education’s website and checking the “Federal Student Loan Borrower Updates” box.

When will student loan forgiveness go into effect?

Forgiveness will happen on a rolling basis. Borrowers have until December 31, 2023 (next year — don’t panic) to submit their application for forgiveness.

The Department of Education said they plan to discharge the forgiven debt within about four to six weeks from the time a borrower submits their application.

If you want to have your loans forgiven before repayment begins (which we talk about more below), the Department of Education recommends that you get your application in by November 15, 2022.

Just 3 steps and you can see student loan debt relief. pic.twitter.com/2Rw8m6qufp

— Secretary Miguel Cardona (@SecCardona) September 5, 2022

Will student loan forgiveness be taxed?

You will not have to pay federal taxes on the forgiven portion of your loans. Under the American Rescue Plan of 2021, student loan forgiveness is tax-free through 2025.

However, states could choose to tax the forgiveness, and the information about which states will impose a tax is changing rapidly. Some states’ income tax laws currently tax discharged loans as income. They would need to change that law — or amend it for this particular circumstance — to keep the forgiven student loans from being taxed.

Several states have already made the necessary changes so discharged loans will not be taxed.

As of this writing, the states where discharged student loans may still be taxed are:

- Arkansas

- Minnesota

- North Carolina

States that have affirmatively stated they will be taxing student loan forgiveness are:

When will student loan repayment start again?

When President Biden announced his student loan forgiveness plan, he extended the pause on federal student loan repayment until December 31, 2022. He told borrowers they should expect to begin making payments again in January 2023. Interest will begin accruing again then as well.

Borrowers may have a little whiplash after experiencing the six previous extensions of the repayment pause during the pandemic. The Department of Education’s Federal Student Aid website states this is the final extension.

Student loan servicers and the Department of Education will be contacting borrowers before the repayment period begins. If you’ve moved during the pandemic, update your contact information with your lender and at StudentAid.gov so you don’t miss any notifications or payments.

If you want to resume automatic payments, you likely need to set that back up again with your loan servicer. It may be as simple as logging into your account and clicking an “auto-debit” button. If you’re not sure how to set up automatic payments, contact your loan servicer.

If you don’t know who your loan servicer is, scroll down on your StudentAid.gov dashboard to the section titled “My Loan Servicers.” You’ll find the name(s) of your loan servicer(s) there.

What if I don’t qualify for student loan forgiveness?

With all the excitement about student loan forgiveness, not qualifying can be a serious disappointment.

Allow yourself some time to be grumpy about it, and then figure out what you can do to get those loans paid off as quickly as you can. Look for a position with an employer that offers student loan repayment benefits. Or better yet, talk to your boss about getting student loan benefits at your company.

Make a habit of paying a little extra to your student loans every month. Those small boosts can make a big impact over the life of your loan.

Ask friends and family to make contributions to your loans in lieu of gifts this year. Or get cash back straight to your loans when you shop online.

Forgiveness is fantastic, but not federal debt relief doesn’t mean you’re shackled with these loans forever.

What are student loan forgiveness calls?

One final note: no one from your loan servicer or the Department of Education is going to call you about student loan forgiveness.

If you receive a call from someone claiming to help you get the $10,000 or $20,000 debt relief, that’s a scam. No company can help you get your debt forgiven faster. And there’s no fee to apply for student loan forgiveness.

If you’re unsure whether information you received from a phone call, email, or text is legit, call the Federal Student Aid Information Center (FSAIC) at 1-800-433-3243.

For everyone who will still have a loan balance this January, we think Daily Dolr is a great way to jumpstart your journey to a debt free life. Set up automatic extra payments to your student loans and take years off your time as a student loan borrower.