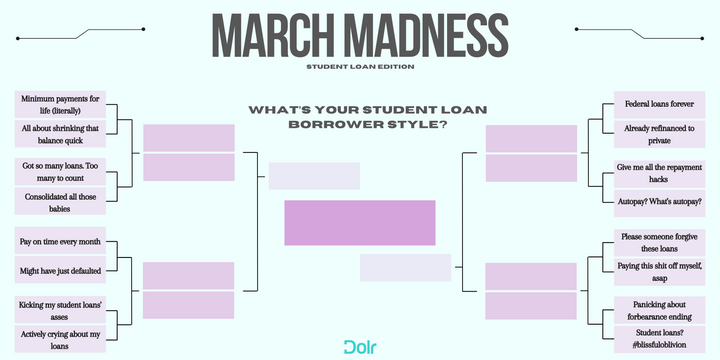

What's Your Student Loan Repayment Personality?

What the what? What do my student loans have to do with my personality?

If you have student loans then you've probably spent a good amount of time exploring a bunch of strategies trying to figure out the best way to pay down your loans. You've probably heard of the snowball and the "highest interest first" strategies.

If you're done with school then you've probably even tried a couple repayment strategies and, hey, if you've found one that works for you consistently then you're well on your way to $0 student debt. Either way, all the strategies out there come down to one basic idea:

Setting goals then rewarding yourself for achieving those goals.

Your repayment personality is a combination of how you set goals and how you reward yourself.

#SquadGoals

With student debt there is only ever 1 goal: getting to $0 debt. Amirite? No. Getting to $0 debt is the objective. Different folks have different ways to set goals towards this objective. People will:

- Mathematically calculate the optimal amount of money they can allocate to their loans monthly then optimize how to distribute that cash between their loans so they are maximally accelerating to $0 debt (full speed ahead)

- Payoff the smallest amount due first (can feel faster)

- Payoff the loan with the highest interest rate first (is faster)

- Pay the minimum payment (is the slowest)

- Get help by asking friends and family to make small payments on their behalf to help them meet their goals

- Default, defer, or enter forbearance

- Enroll in Public Service Loan Forgiveness (PSLF) programs

- Switch between these because life happens and consistency can be hard when everything is a bill but you still want to live your life

If you have other strategies I'd love to learn about them! Email us at hello@getdolr.com

One easy way to set yourself up for success is to tell your loan servicer what to do with the money when you over pay by making an Overpayment Allocation Direction. Typically, if you overpay the loan servicer will hold the sum and apply it to the next payment when it's due. So, even though you feel like you've done the right thing, your loan balance will not reflect it. Typically, you can tell them how to allocate overpayment by logging into your account and navigating to your profile to set it up.

Then, you can make your minimum payment or pay interest that is accruing and whenever you have any extra cash you can put it towards your student loans and know that it will be making a real difference.

Setting goals and trying your best to work towards them is valuable because it's measurable and when you're meeting your goals everything just feels better, right? Sometimes. If you're intentional about rewarding yourself for meeting your goals? Definitely.

Reward thyself

Do good things. Reward yourself for doing good things. Do more good things. That's the idea. Easier said than done though. How do you reward yourself for paying down your student loans? Some folks would argue that just paying off the loans is reward enough. Sure, if that's what motivates you.

Nature has hard wired us to keep doing things that feel good and avoid things that don't feel good. When it comes to building good habits though, the "feel good" aspect of that can be pretty challenging. We've all tried to spend less, live healthier, save for the future, or do any number of things we know are good for us. So why have we all failed at at least one of these things?

Because we set goals without creating rewards that actually work for us.

People say getting started is the hardest thing to do so to build good habits we should focus on just getting started. Sure, that's important but let's be honest. How many times have you started something with the best intentions and a few weeks (days?) later it's like "oh what? Right, I did start doing that thing. Hmmm, I'll get back on it tomorrow." Consistency is key. Getting started is easy. Being consistent is hard.

Paying down student loans is hard. Like losing weight, it takes a little while to start seeing the results. To focus on making it through for long enough to start seeing results you can try:

- Making a spreadsheet tracking every dollar and visually highlighting goals and the path to success

- Making the goal less painful by making smaller weekly payments instead of one large monthly one

- Asking your employer to send a portion of your pay directly to your loans before the money lands in your account. So the only balance you see going down is your student loan balance. Dolr can help with this, just send us an email: hello@getdolr.com

- Asking your employer to offer a Student Loan Repayment Benefit so you have more cash going towards your loans. Dolr can help with this too! Email us: hello@getdolr.com

- Creating a gift jar - for every $100 dollars of debt paid down put $5 dollars in a jar. When you pay off $1,000 go get yourself a nice $50 gift

- Pick a guilty pleasure then before indulging "pay" for it by doing something towards your goal. For example, I love me a good fancy coffee. So, when I want to go buy a $5 coffee I first pay $5 towards my debt. So when I spend that money on something I don't really need I balance it by paying a little towards my debt.

- By redeeming your loyalty rewards directly to student loan repayment earn seamless rewards that help you beat student loans faster so you can build wealth sooner.

- Ask your employer why they aren't helping you with your student loans by offering student loan repayment assistance as a perk.

How else do you reward yourself? I'd love to learn more! Email us at hello@getdolr.com

Approaching terminal velocity

You are a lot more than your student loans. By being honest with yourself about who you are, you can set your goals, whether you're calculating the optimal amount and distribution, paying the smallest loan first, paying the highest interest rate first, crowdfunding, taking a breather, or all of the above. You can set goals that work best for you.

Then, you can reward yourself by creating a spreadsheet visual, making smaller more frequent payments, paying directly from payroll, getting yourself gifts when you hit milestones, or paying your loans when you reward yourself. Find the rewards that most motivate you.

Finally, if you can, automate the process so there are fewer decisions you have to make - and honestly, fewer opportunities to miss your goals. You can set this up yourself, use any of the software available for financial planning, or get Dolr where we're laser focused on helping people like you accelerate to $0 student debt by just being you (this is my favorite option, 😜).

Your repayment personality is a combination of how you set goals and how you choose to receive rewards.

So, what's your student loan repayment personality?